Havila Voyages: strong balance sheet and liquidity

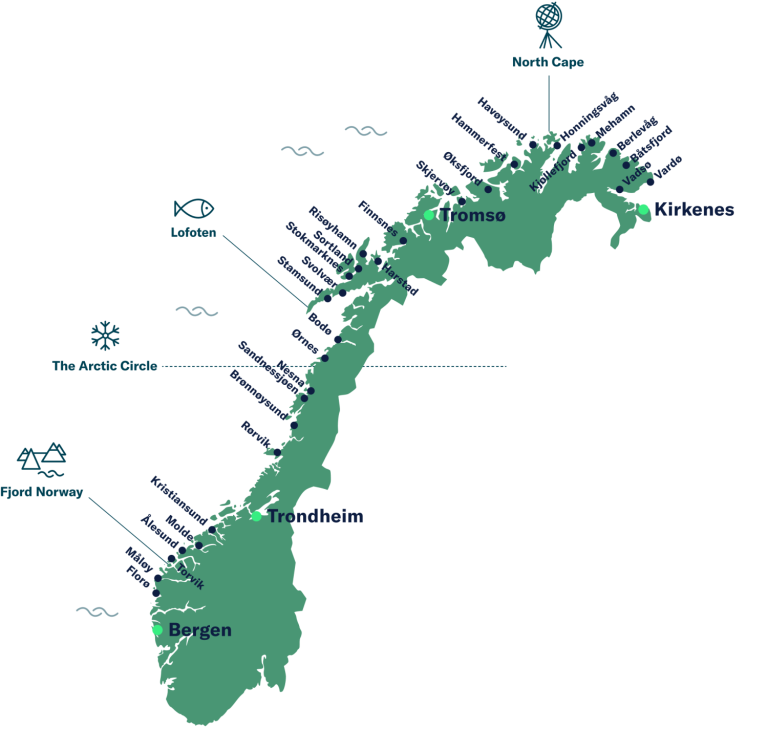

Havila Voyages (Havila Kystruten AS), a Norwegian shipping company that operates coastal voyages between Bergen and Kirkenes, has completed a refinancing that ensures the company has stronger liquidity and balance sheet.

HAVILA VOYAGES

HAVILA VOYAGES Bergen – Kirkenes

In the quarterly report for the last quarter of 2023, Havila Voyages announced a refinancing of the secured bond loan, including the related repayment costs and accrued interest.

The company refinanced this loan through a €56 million loan granted by Havila Holding AS. The loan is unsecured and provides the company with greater financial flexibility to manage seasonal liquidity fluctuations. It replaces the secured debt with unsecured debt at a lower cost, which will mature entirely on July 26, 2028.

“As a company, we considered various alternatives within the loan contract for the remaining secured bond and overall we believe this is the best solution for us,” says CEO Bent Martini.

Series A of Havila Voyages’ secured bond loan has a nominal value of €255 million and was issued in July 2023 specifically for the delivery of Havila Polaris e Havila Pollux.

havila-polaris-e-havila-pollux-consegnate

Havila Pollux

It is noteworthy that the four new ships are equipped with the world’s largest battery pack and can sail for four hours without noise or emissions through the fjords. The batteries are charged onshore with clean hydropower, and when the batteries are depleted, we switch to natural gas, reducing CO2 by about 25%.

“With this solution, we ensure greater liquidity and balance for the company, and we can focus on optimizing the operation of our four new ships and achieving the set operational goals. There is no doubt that the bond loan is expensive, but this was the only solution at the end of last summer. The goal has always been to find lower-cost solutions, and this is a further step forward. Over time, this will also enable more sustainable and long-term financing, which better reflects the solid values of Havila Voyages,” says Martini.

Havila Voyages also noted a positive trend in bookings. The occupancy for the first quarter of 2024 ended at 68%, up from 60% in the fourth quarter of 2023. For this year, 63% capacity has been reached so far, and an average occupancy rate of just under 80% is expected.

“For a new company on a well-established route, we are very pleased with the booking trend. We are receiving positive feedback from guests, and we see more returning customers. We are aware that the market is growing. Therefore, we are optimistic about the future!” concludes Martini.

Be sure to read in-depth articles and news from the cruise world on our website Cruising Journal.